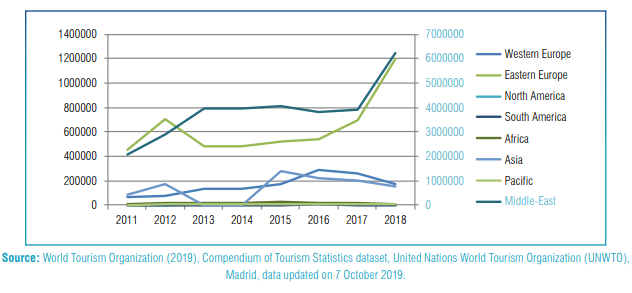

Iran’s strategic geographical position imparts strong potential for fostering regional integration by facilitating robust connectivity to Central Asia (via Turkmenistan), to Europe (via the Republic of Turkey), to the Mediterranean countries (via Iraq, and now India) and beyond (through Chabahar Port). This strategic position in West Asia, bordering the Caspian Sea, Persian Gulf and the Gulf of Oman close to shipping lands and key markets, has always part of Iran’s larger positioning strategy, and serves as a valuable base for accessing markets. Iran has been in discussions with neighboring partners such as Pakistan, Oman, Qatar and Iraq (Basra) for using their shipping lines and ports. Iran’s trade has shifted towards emerging economies in the region and East Asia, signaling gradual momentum in terms of market diversification, though considerable concentration in export markets remains (Figure 1). By value, the most important importers of Iranian goods exports in 2018 were China (9.5%), Iraq (9.3%), the United Arab Emirates (6.2%), Afghanistan (3.0%) and the Republic of Korea (2.7%). Market diversification has the potential to improve the scale of Iran’s exporting while helping to mitigate the effects of economic headwinds.

Figure 1: Top export market

The following sectors have been selected as priority sectors:

• Medicinal herbs

• Fruits and vegetables

• Petrochemicals

• Auto parts

• Information and communications technology

• Tourism

MEDICINAL HERBS

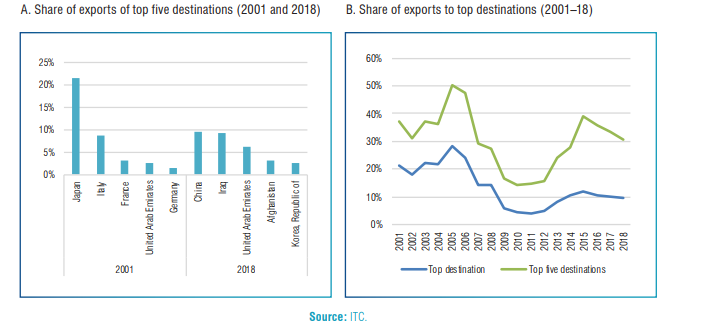

While precise numbers are difficult to determine, global demand for medicinal herbs is large and growing. The drivers of this demand are factors such as ageing populations in developed countries, the rise in chronic disease and unhealthy lifestyles, the rising costs of medical treatments and the stress associated with modern lifestyles. An estimated 4,000–6,000 species are traded globally, providing a source of income for rural populations. Iran has the potential to leverage its natural diversity of medicinal plants, heritage of more than 3,000 years of traditional medicine, existing capacities and widespread natural and organic cultivation methods, and innovations in supplying global demand. The two major exported products are saffron and Persian shallots, together representing approximately 81% of exports from the sector, with considerable growth in recent years (Figure 2). Exports of other medicinal herbs have been stagnant. The United Arab Emirates and the Kingdom of Spain together represent almost 50% of Iran’s total saffron exports. Much of the saffron sold to Spain is eventually re-exported.

Figure2: Export markets and export products for raw medicinal herb product(2018)

FRUITS AND VEGETABLES

The volume of fresh and processed fruits and vegetables traded globally has more than tripled since 2001, with increasing demand from developing economies in particular. Nevertheless, there are high levels of competition in the sector, and success in exporting depends on factors including production capacities, efficient value chains, certification, environmental sustainability, differentiation and branding, and reaching niche markets. Iran’s temperate climate is generally well suited to the production of fruits and vegetables, and various microclimates around the country are suited to the needs of particular products, resulting in high-value and a strong export orientation. However, the high quality of Iranian produce has yet to be discovered by new potential buyers beyond the regional, and sometimes, trade relationships based on convenience. The sector is estimated to have significant potential for improving exporting and job creation if challenges to its competitiveness and sustainability can be addressed. Together, exports of fruits, nuts and vegetables (including prepared products) were worth $3.3 billion in 2018. Although the importance of these products has been declining in much of the past two decades, they still represent 11% of total exports. Some major products include figs, apples, melons, grapes, tomatoes and potatoes, which had a combined export value of $1.2 billion in 2017.

PETROCHEMICALS

New producers and new sources of demand arising in emerging economies are changing the global petrochemicals sector, and considerable opportunities exist for Iranian exports. Facing growing global demand, but also increasing competition from emerging producers around the world and within the region, a more diversified and competitive Iranian petrochemical sector has the potential to further expand its exporting by leveraging the country’s resource endowments and existing production capacities. The sector strategy support seizes the potential in petrochemical exporting by addressing the most important challenges being faced. The Iranian petrochemical sector has grown as a result of natural assets and exogenous factors, such as:

• Access to raw materials, a strategic location and strong domestic demand;

• Sector organization factors, such as its established and growing industrial capacity, supportive policy environment and strong fundamentals to attract investment;

• Human and technology factors, such as the pool of experienced labor and higher education capacities.

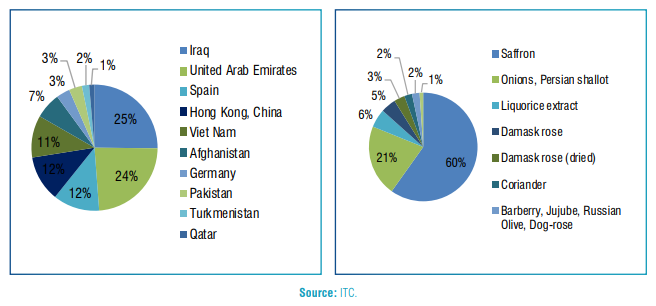

Exports have grown too; organic chemical exports were worth $4.1 billion in 2018, representing 13.6% of total non-fuel exports. Combined with plastics and fertilizers exports, the other major categories of petrochemical products, Iran exported $10.5 billion in 2018 (Figure 3). Approximately half of this was destined for China, though Iraq, India, the United Arab Emirates and Turkey are also important markets.

Figure3: Petrochemical exports (2001-2018)

AUTO PARTS

The global auto parts sector, and broader automotive sector, are major contributors to international flows of trade and investment, though they are undergoing change as a result of emerging trends, including the rise of new sources of demand in middle-income economies, shifting regulations and market expectations on vehicles and components, and technological change. Iran and other exporters of parts will, therefore, need to be flexible in order to succeed in international markets. Auto parts manufacturing in Iran is a significant source of value added, employment and exports, both directly and indirectly. This is due to natural assets and exogenous factors such as the large domestic automotive sector and proximity to important export markets; sector organization factors such as established and growing capacity in auto parts production and supportive government policy; and human and technology factors, particularly high levels of human capital. The sector has the dynamic potential to contribute to innovation and diversification through the development of manufacturing capabilities and cross-linkages with other industries.

INFORMATION AND COMMUNICATIONS TECHNOLOGY

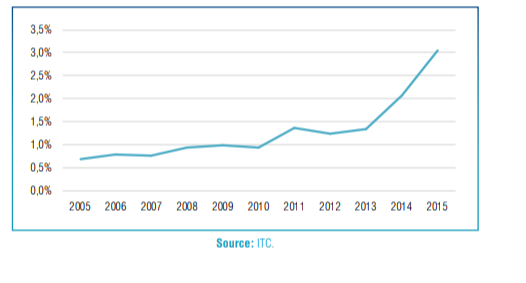

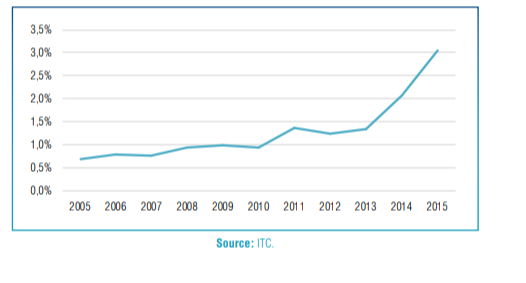

Globally, the information and communications technology sector accounts for a small, but growing share of trade, led by large producers such as China, the Federal Republic of Germany and the United States, which are the largest contributions to exports. Nevertheless, ICT has proven to be important to Iran’s growth, and as tradable services these have significant potential to drive export growth. However, challenges related to firms’ domestic focus and the policy and entrepreneurship environment can be adequately addressed for this growth potential to be realized. The software development, financial technology (fintech) and e-commerce subsectors are particularly promising, and are the focus of the sector strategy. Iran’s ICT export potential has been demonstrated in the past. Computer services exports, for example, have been small, but are growing quickly as a share of total services exports. In 2005, these exports accounted for just 0.7% of services exports, though this increased to 3% in 2015, when they were worth $338 million (Figure 4). Its performance has been driven by investment in ICT infrastructure, domestic demand, the government’s recognition of the sector’s potential in terms of its direct economic contribution and as a leader in the development of a knowledge-based economy, and the development of required skills.

Figure4: Computer services exports(2005-2015)( Percent of services export)

TOURISM

Changing demographics, advances in technology, shifting social mores and behaviors, and other influences have caused major shifts in the tourism industry, with tourists increasingly looking for experiences or services that closely match their ideals and expectations. International tourism is a promising sector in Iran that can continue to grow and produce wider benefits for the economy and society. The potential of Iran’s tourism sector and focus of the sector strategy is on the ecotourism and community based tourism, medical tourism, and cultural and historical tourism subsectors. This builds on the country’s strengths, which include natural, cultural and technical endowments to generate growth, trade and employment opportunities, which have yet to be tapped. Current international visitors mainly come from within the region. Out of the 5.1 million tourist arrivals into Iran in 2017, more than 70% came from short-haul markets, especially from neighboring countries. This increased to 90% in 2018 with 7.8 million tourist arrivals (Figure 5).

Figure5: International visitor arrivals to Iran by region origin(2011-2018)